Fed Balance Sheet Reduction Explained

The Federal Reserve’s balance sheet is a critical tool for implementing monetary policy and has grown significantly over the years, particularly after the 2008 financial crisis. The Fed’s holdings of Treasury securities, mortgage-backed securities, and other assets, which expanded to more than $8.9 trillion as of 18th April 2022, have played a crucial role in supporting the economy and financial markets.

However, the inflationary pressures and threats to financial stability made the Fed begin reducing its large balance sheet. We will learn in detail about the Fed balance sheet reduction, the reasons for the process as well as the implications.

What is Fed balance sheet reduction?

The Fed Balance Sheet Chart

It is important to understand why the Federal Reserve began the process of balance sheet reduction. During the financial crisis of 2008, the central bank implemented a number of policies to stabilize the financial system and support economic growth. One of these measures was quantitative easing (QE), which involved purchasing large quantities of Treasury securities and mortgage-backed securities in order to inject liquidity into the financial system and lower long-term interest rates.

Through its QE program, the Fed was able to dramatically increase the size of its balance sheet, which can be seen from the chart above; the increment began after 2008.

This large balance sheet was a key component of the Fed’s efforts to respond to the crisis and support the economy, but it also created potential risks and challenges for the central bank. One challenge associated with a large balance sheet is that it can make monetary policy less effective. When the Fed buys securities, it increases the reserves held by banks, which can stimulate lending and promote economic activity. However, if there are too many excess reserves in the system, it can disrupt financial markets and reduce the effectiveness of monetary policy.

Despite these challenges, the Fed has maintained its large balance sheet for several years; from the chart above, the increment began after the 2008 crisis and continued gradually to 2018, with minor reductions within this period. However, as policymakers and economists became concerned about the risks associated with maintaining such a large asset portfolio by the Fed, there was a need for reduction. As a result, the Fed announced in 2017 that it would begin a process of gradually reducing its balance sheet, with the goal of eventually returning it to a more normal size.

The Fed balance sheet reduction then started in 2017 until COVID-19 struck, forcing the Fed to begin another process of quantitative easing to support the economy. The aftermath of this is an increment in the inflationary rate (causing a rise in the prices of goods and services).

To control inflation and also normalize its balance sheet, The Federal Open Market Committee (FOMC) announced, at its May 2022 meeting, that it will start reducing the size of the Federal Reserve’s balance sheet significantly. This process has been started in 2022 and has continued into this current year, 2023. The goal of this balance sheet normalization is to return the Fed’s balance sheet to a more normal size and to gradually remove the monetary stimulus that was put in place during the COVID-19 pandemic. The reduction process involves gradually unwinding the Fed balance sheet portfolio holdings while carefully managing associated risks because it has implications for the US economy and financial markets.

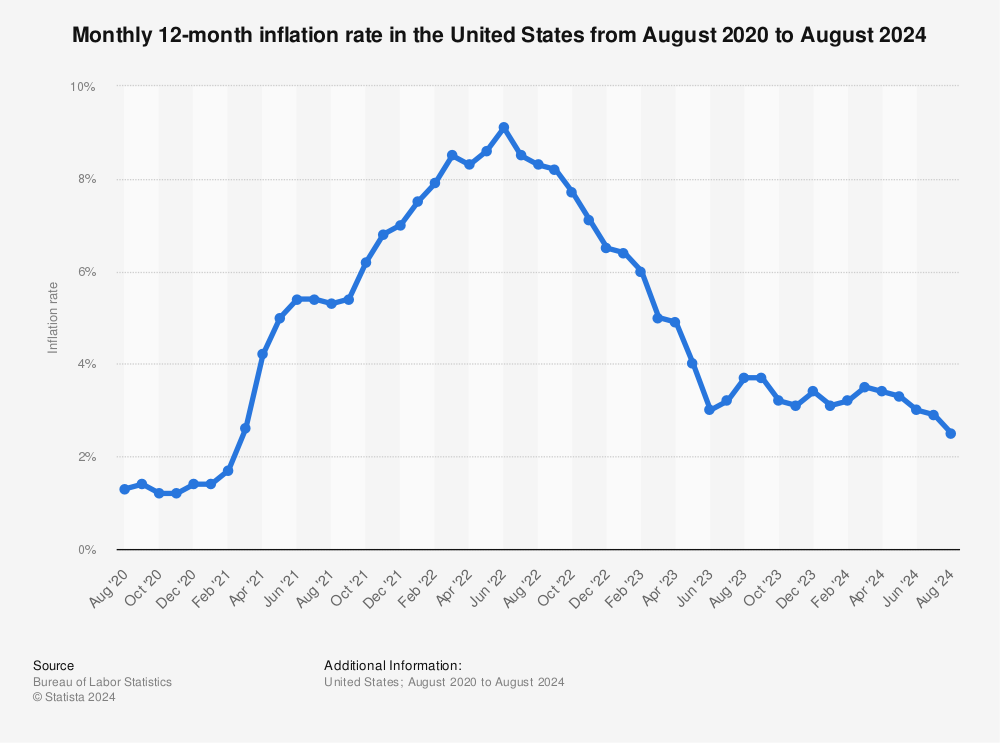

The effect of the Fed balance sheet reduction can be seen in the U.S. inflationary chart below. Inflation rates have reduced from 8.5% in March 2022 to 5% in March 2023.

Find more statistics at Statista

Importance of the Fed Balance Sheet Reduction

The need for balance sheet reduction is an important consideration for the Federal Reserve, given the challenges associated with maintaining a large balance sheet. Quantitative tightening is needed in order to avoid the risks associated with a large balance sheet which are listed below:

- To avoid a situation where the central bank is unable to respond to economic shocks or changes in financial conditions because of a large balance sheet. This is because a large balance sheet can complicate the implementation of monetary policy, potentially leading to unintended consequences such as distorted market signals or reduced effectiveness of interest rate changes.

- To prevent distortions in financial markets. For example, when the Fed holds onto too many government securities, it can cause an excess supply of these securities in the market, which in turn can depress prices and impact liquidity.

To address these challenges, the Fed balance sheet reduction is important to shrink the size over time in order to promote stability and flexibility in the economy.

How does the Fed reduce its balance sheet?

The expected timeline of the Fed balance sheet reduction could extend over several years. The specifics of the Fed’s plan for balance sheet reduction may include any or a combination of the following:

- Gradual sales of securities: The Fed may gradually sell off a portion of the securities it acquired during its quantitative easing program, such as Treasury securities and mortgage-backed securities. The pace of these sales will be determined by economic and market conditions, as well as other factors such as changes in interest rates.

- Limiting reinvestment: As securities in the Fed’s portfolio mature, the central bank can limit the amount of reinvestment it makes in new securities, this is called balance sheet runoff. This will help to gradually reduce the size of the Fed’s balance sheet, as well as the level of excess reserves in the banking system.

- Flexibility and transparency: The Fed has stressed that it plans to approach balance sheet reduction in a flexible and transparent manner. It will adjust the pace of security sales based on the economic outlook and will communicate its policy intentions in a clear and open way to promote market stability.

- Maintaining policy objectives: Throughout the Fed balance sheet reduction process, the intention is to maintain the policy objectives of promoting maximum employment and stable prices. If necessary, the central bank may adjust its interest rate targets or other policy tools to achieve these objectives.

The specifics of the Fed’s plan on shrinking its balance sheet will continue to evolve over time, based on the performance of the broader economy and financial markets, as well as the needs of the central bank to manage its balance sheet risks effectively. It is never a straightforward process.

Implications of the Reduction for the US Economy and Global Markets

The reduction of the Federal Reserve’s balance sheet has important implications for the US economy and the global financial markets. The Fed’s balance sheet is a key determinant of monetary policy, and its size and composition can affect interest rates, credit availability, and financial market stability. As the Fed continues to reduce its balance sheet, it will likely lead to higher borrowing costs for consumers and businesses, making it more expensive to obtain credit, which could have a dampening effect on economic growth.

Another effect of the Fed balance sheet reduction is a possible downward pressure on prices, leading to lower inflation rates.

Furthermore, there could be potential spillover effects on global financial markets, particularly in emerging economies, as investors readjust their portfolios in response to changes in the Fed’s balance sheet.

Possible Challenges in Achieving the Reduction Targets

Achieving the Fed’s reduction targets may pose some challenges, particularly if the economy experiences unexpected shocks or if market conditions change. For example, if inflation were to pick up unexpectedly, the Fed may need to delay or slow down the pace of its balance sheet reduction. Alternatively, if economic growth were to slow or if financial markets were to become unstable, the Fed may need to adjust its reduction plans to avoid exacerbating these conditions.

To ensure unexpected changes in the economy and the global market, it is important that the Fed communicates its balance sheet reduction plans effectively to market participants, policymakers, and the public at large. By doing so, the reduction process is likely to proceed smoothly and any risks or disruptions are minimized.

As the U.S. economy and global financial markets continue to evolve, the Fed may need to adjust its approach to the management of its balance sheet to ensure that it achieves its monetary policy goals while also promoting financial stability and supporting economic growth.