Indirect Cash Flow Statement

The term “indirect cash flow statement” is used to describe an indirect method of preparing a statement of cash flow (one of the two ways of preparing a cash flow statement). It is another way of presenting data that shows the amount of money that is spent and made during a specific accounting period and from what sources. It involves taking a company’s net income and adding or deducting balance sheet items to determine cash flow. In this article, we will see in detail an indirect cash flow statement, how to prepare it, an example, and how it differs from a direct cash flow statement.

Read also: Loss on Income Statement

What is an indirect cash flow statement?

In essence, the indirect cash flow statement measures the amount a company made or spent through various sources over a given period. It helps in the evaluation of a business’s relative health and financial stability as well as whether a firm has money to spend on growth and other investments or not.

As stated previously, the indirect method calculates cash flow through the adjustment of net income with the differences from noncash transactions. This starts with the net income and then lists cash flows, both received and paid for different activities. So, these activities will then be added or subtracted from a business’s net income in order to determine its final net increase or decrease in cash over the specified period.

The indirect cash flow statement explained

In preparing the indirect cash flow statement, the accrual basis of accounting is used in its calculations. With accrual accounting, a business records revenue as soon as it is earned rather than when it is received. This implies that when a sale takes place, the transaction is recorded, rather than when the money reaches the bank account. In essence, both cash and credit transactions are involved, thereby providing a clearer picture of a business’s financial health.

The cash flow statement generally is one of the components of a company’s set of financial statements which reveals the sources and uses of cash by a business. It gives the reader information about cash generated from operations and the effects of different changes in the balance sheet on a company’s financial position.

Just as it is with the direct cash flow statement, cash flows in the indirect cash flow statement are divided into cash flow from operating activities which records the company’s operating cash movement, cash flow from investing activities which is the money made from any investments (which may include the sale of assets, sale of equipment, or long-term assets or investments), and cash flow from financing activities which is the cash level from stocks (this can include the purchase of company stock, issuing bonds, or interest/dividend payments). Sometimes, the fourth category exists to provide an area to record other cash flows. It is known as the supplemental category, though it is rarely used.

The indirect cash flow statement is very popular because the information required for its preparation is relatively easily assembled from the accounts that a business usually maintains in its chart of accounts. It is, however, not favored by the standard-setting bodies since it does not give a clear view of how cash flows through a business. So, the alternative reporting method is the direct cash flow statement.

Read also: Capital Market Instruments, Examples, and Types

How to prepare cash flow statement with indirect method

- Gather the necessary documents

- Begin with net income

- List non-cash operating activities

- List cash operating activities

- List liabilities

- Calculate operating adjustments

- Add investing activities

- Add financing activities

- Calculate the net increase or decrease

- Determine the cash balance

When preparing the indirect cash flow statement, these steps should be followed, they are explained below.

Gather the necessary documents

Here, you look out for the information needed to prepare a cash flow statement from a company’s balance sheet and income statement. The balance sheet shows the assets and liabilities of a company e income statement shows its expenses and revenue.

Start with net income

The net income for the current accounting period will be the first line item in preparing a cash flow statement. One can list gains or losses on each line below this figure and then add or subtract their totals from the net income while the process goes on. The deductions should be shown in parentheses.

List non-cash operating activities

Add or subtract from the net income non-cash gains, losses, or expenses including depreciation, amortization, depletion, gains or losses from the sales of assets, and losses from accounts receivable. Now, all depreciation expenses are to be grouped and use the total as the depreciation figure.

List cash operating activities

In this step, all cash gains or losses will be listed on each subsequent line including expenses, inventory, and accounts receivable. In the course of adjusting the net income for cash gains and losses. Increases in assets should be subtracted from the income and decreases in assets should be added to the income.

List liabilities

For the last component of the operating activities, the net income for cash changes is to be adjusted to liability accounts such as accounts payable and accrued expenses. Liability adjustments are directly opposite to asset adjustments, meaning that one adds an increase in liability to the net income and subtracts decreases in liability from the income.

Calculate operating adjustments

Here, the total of all the adjustments in this section is to be placed on a line labeled “Net cash from operating activities”.

Add investing activities

Here, one should be at the second section of the indirect cash flow statement. In this section, one would simply add or subtract all investing activities such as buying or selling stock or assets for the period to calculate net cash from investing activities.

Add financing activities

In this section, all actions carried out by the company to finance its operations for the period are to be added or subtracted to arrive at the net cash from financing activities.

Calculate net increase or decrease

The totals derived from the operating, investing, and financing sections should be added together in order to arrive at the company’s net increase or decrease in cash.

Determine the cash balance

On the last lines of the statement, one should list the beginning/opening cash balance, adjust it to the net increase or decrease amount, then list that adjusted figure as the ending/closing cash balance on the next line. In this case, the opening and closing balance figures are useful for the assessment of financial performance over time.

Example of indirect method cash flow statement

Let us assume that the information has already been extracted from the company’s balance sheet and income statement.

| INDIRECT CASH FLOW STATEMENT | Debit ($) | Credit ($) |

|---|---|---|

| Cash flows from operating activities | ||

| Net income | 3,500,000 | |

| Adjustment for: | ||

| Depreciation and amortization | 120,000 | |

| Provision for losses on accounts receivable | 45,000 | |

| Gain on sale of asset | (65,000) | 100,000 |

| Increase in trade receivables | (200,000) | |

| Decrease in inventory | 350,000 | |

| Decrease in trade payables | (25,000) | 125,000 |

| Cash generated from operations | 3,725,000 | |

| Cash flow from investing activities | ||

| Purchase of property, plant & Equipment | (550,000) | |

| Proceeds from the sale of equipment | 65,000 | |

| Net cash used in investing activities | (485,000) | |

| Cash flow from financing activities | ||

| Proceeds from the issue of common stock | 160,000 | |

| Proceeds from the issuance of long-term debt | 185,000 | |

| Dividends paid | (65,000) | |

| Net cash used in financing activities | 280,000 | |

| Net increase in cash & cash equivalents | 3,520,000 | |

| Cash and cash equivalents at the beginning of the period | 1,480,000 | |

| Cash and Cash equivalents at the end of the period | 5,000,000 |

Read also: What is a Fortress Balance Sheet?

Cash flow statement indirect method example

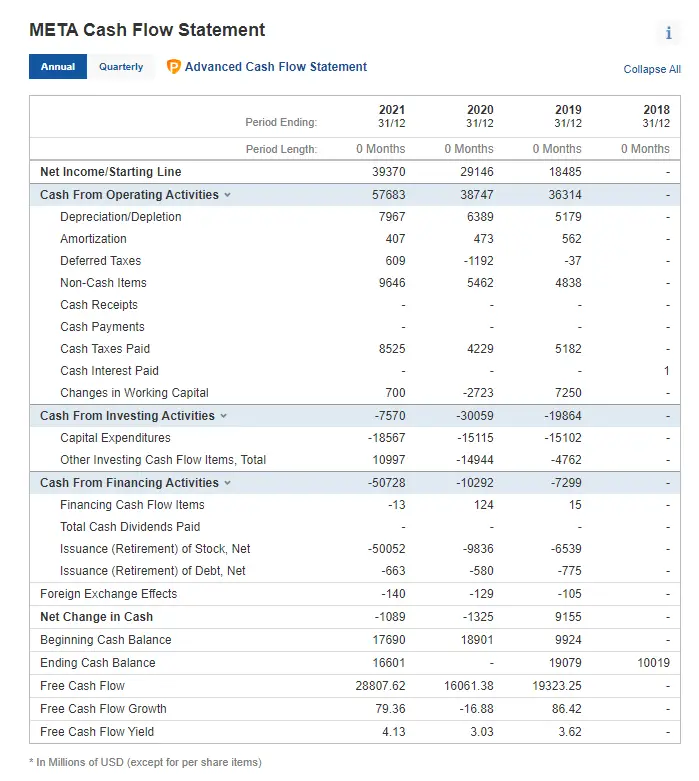

Below is an example of a cash flow statement of META (Facebook), prepared using the indirect method

Direct vs indirect cash flow statement

In the direct cash flow statement, one does not start calculations from a company’s net income and factor cash receipts and payments into the total balance. On the other hand, the indirect method starts calculations with the net income which is adjusted for changes in the balance sheet accounts.

The direct cash flow statement makes use of cash accounting while the indirect cash flow statement makes use of accrual accounting which involves reporting income for the period in which it was earned rather than received.

Usually, both methods arrive at the same result, however, many accountants prefer the indirect method because it is easier for them to prepare using information from already existing financial documents.