Accounts receivable: Debit or Credit?

Is accounts receivable debit or credit entry? The majority of businesses offer goods or services to their customers on credit. That is, customers are allowed to get goods or receive services and then pay later. In bookkeeping, the business records these goods or services given to customers on credit as Accounts receivable. It is the money that is owed to the business, so it is not reported on the company’s income statement but in the balance sheet and trial balance.

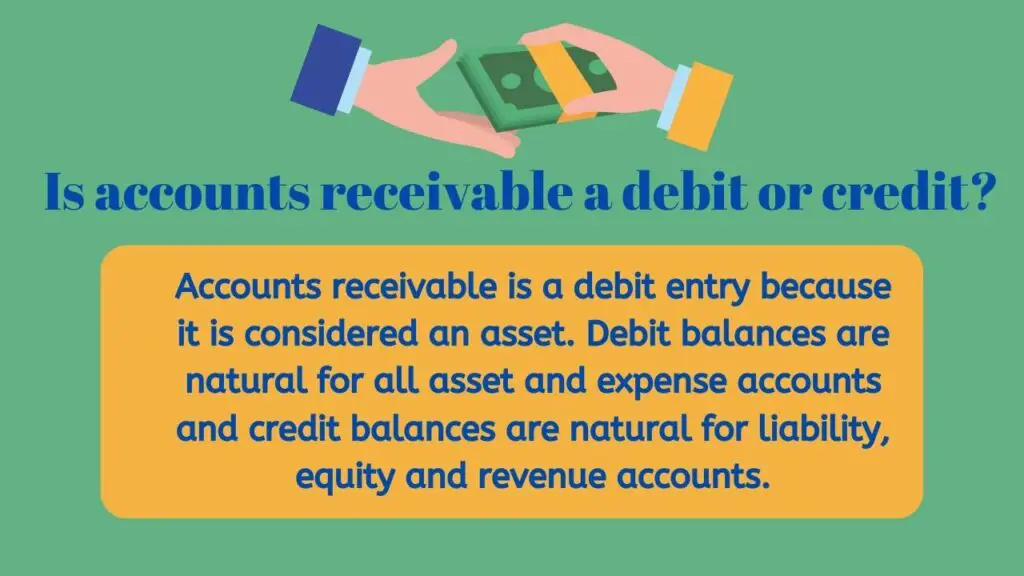

Accounts receivable are considered an asset on the balance sheet and as such recorded as a debit and not a credit. Understanding debits and credit and how they help form the basics of double-entry accounting will help us understand why accounts receivable is a debit entry and not a credit entry. In this article, we will discuss how and why accounts receivable is a debit entry and not credit. But first, let’s have a proper understanding of the double entry system (debit and credit).

Related: Is Accumulated Depreciation Debit or Credit?

Understanding debits and credits

In business, the transactions that are carried out have a monetary impact on the financial statements of a company. Hence, when it comes to bookkeeping, one always has to be sure that their financial entries are correct and accurate. The correct data and numbers have to be entered each and every time a transaction is completed in the business.

When accounting for business transactions, the numbers are recorded in two columns, the debit and credit columns. Debits and credits are used as a way to record every transaction that occurs within a business’s chart of accounts. When a transaction is being reported in the books, it is compulsory for every debit entry to have a credit entry that corresponds with it while equaling the same amount. That is, when it comes to accounting, every transaction has to be exchanged for something else that has the exact same value.

Hence, the total of debit and credit entries for any transaction must always equal each other so that the accounting transaction is considered to be in balance. If they are not in balance, it would be difficult to create financial statements. Debits and credits play a major role in the bookkeeping of a business to balance out correctly. A credit entry will increase revenue accounts, equity, or liability while reducing expense or asset accounts. Whereas, a debit entry will increase expense or asset accounts while reducing liability, equity, or revenue accounts.

Bookkeepers and accountants frequently make use of debits and credits when recording transactions in accounting records. For every transaction done, an amount must be entered in one account as a credit (right side of the balance sheet) and in another account as a debit (left side of the balance sheet). This accounting system is known as a double-entry system which helps to provide accuracy in accounting records and financial statements.

Double-entry accounting

The debits and credits entries are made in account ledgers to record changes in value that result from business transactions. A credit entry is created to always add a negative number to the journal whereas a debit entry adds a positive number. However, in the actual journal entries, you won’t see pluses and minuses written, but rather the left-side and right-side formats are used. A debit will always be positioned on the left-hand side or column of the ledger while credit will always be positioned on the right-hand side of the ledger.

Using debits and credits in the two-column transaction recording format happens to be the most essential of all controls over accounting accuracy. Entering a debit in an account would basically mean a transfer of value to that account, while a credit entry would mean a transfer of value from the account. In business, each transaction transfers value from credited accounts to debited accounts. Therefore, at least two accounts are affected with a debit or credit entry when a transaction is made.

Take, for instance, a company borrowing money from a bank. This transaction affects the company’s Cash account and the company’s Notes Payable account and even when the loan is paid, the Cash account and the Notes Payable account are still affected. The same thing happens when a company buys supplies with cash, the company’s Cash account and its Supplies account will be affected. Now, if the company buys the supplies on credit, the Supplies account and Accounts Payable will be involved.

Furthermore, if a company renders a service to a client and gives him/her 30 days to pay, the company’s Accounts Receivable and Service Revenues accounts will be affected. For each transaction explained above, one account will be debited and one credit for the transaction to be in balance. As seen from the instances given, for every transaction, two accounts are at least affected with a debit or credit entry. This is why this accounting system is said to be a double-entry system.

Nevertheless, even though the accounting system is said to be double-entry, a transaction may involve more than two accounts. For instance, when a company makes a loan payment to its bank, the transaction involves three accounts which are Cash accounts, Notes Payable accounts, and Interest Expense accounts.

Conclusively, debits and credits are used in double-entry accounting record transactions in a company’s chart of accounts. However, the challenge of double-entry accounting might be understanding which account should have a debit entry and which should have a credit entry. When it comes to the money owed to the company, is accounts receivable a debit or credit? Let’s look at what accounts receivable are on financial statements to understand its correct entry in a journal.

See also: Expense: Debit or Credit?

What are accounts receivable?

How does it work? A company may provide goods or services to a customer if they are willing to pay for the services or goods in the future. Though the company provides a date to the customer on which the debt will be due. Therefore, AR usually has terms that require payments due within a relatively short period which usually range from a few days to a fiscal or calendar year.

The company records the credit sales transactions by opening a new account called account receivables which are accounted for in the asset book of the seller. The buyer owes the seller a sum of money against the goods and services already rendered by the seller. Account Payables are the opposite of accounts receivable; it is created in the liability book of the buyer for the money he owes.

Accounts receivable, sometimes called ‘trade receivable’ reports the amounts that a business has the right to receive because it has already delivered a product or service. An example of a Accounts Receivable account is when an electric company bills its clients after the clients have received and used the electricity. The electric company reports the unpaid invoices as accounts receivable as they wait for their customers to pay their bills. Several companies operate by allowing a portion of their sales to be on credit, especially to frequent or special customers that receive periodic invoices. This offer allows their customers to avoid the stress of physically making payments as each transaction occurs.

Accounts receivable on the balance sheet

Accounts receivable are considered an asset on the balance sheet and as such should be recorded as a debit and not a credit in a journal entry. Expenses and assets have natural debit balances. Hence, the positive values for assets and expenses are debited and the negative balances are credited. On the balance sheet, accounts receivable are characterized as current assets. It is being considered current assets because they are sales that have been made on credit and are expected to be paid soon according to the credit terms mentioned in the invoice that the company has issued.

Accounts receivable are usually convertible into cash in less than one year, so, companies confidently record them as an asset on their balance sheets. In a situation whereby the accounts receivable amount converts to cash in more than one year, it is recorded on the balance sheet as a long-term asset (possibly as a note receivable) and not a current asset.

The customers are usually bound by a legal obligation to pay the debt. However, there are times that the customer doesn’t pay for what they owe. This results in a non-payment that is recorded as bad debt. Therefore, accounts receivables are an investment that includes both risks and returns. It can bring returns in the form of new customers and risk in the form of bad debt. Therefore, since there is a possibility that some receivables will never be collected, the account is offset (under the accrual basis of accounting) by an allowance for doubtful accounts.

Having known what accounts receivable are; is accounts receivable a debit or credit? Let’s look at the account receivable entry in the balance sheet.

Related: Liabilities Examples in Accounting

Is accounts receivable a debit or credit?

Therefore, accounts receivable are debited as it is part of the current assets on the asset side of the company’s balance sheet. On the balance sheet, accounts receivable are listed as one of the first, or current, assets because payment is expected in one year or less (short-term).

Is accounts receivable debit or credit on trial balance? Accounts receivable is a debit on a trial balance until the customer pays. Once the customer has paid, accounts receivable is credited and the cash account is debited since the money is now in the bank and no longer owed to the company. Therefore, the ending balance of accounts receivable on a trial balance is usually a debit.

See also: Is Dividend an Asset?

Accounts receivable; debit or credit? (examples)

There may be several journal entries for accounts receivable relating to different transactions. In our examples below, we will be looking at the basic and common journal entries relating to accounts receivables.

Journal entry for sales made on credit

Assume Company ABC sold some pharmaceutical products on credit to Mr. Peter on the 1st of September, 2020. Say, the total amount on the invoice was $30,000 which has to be paid on or before 1st October 2020.

In this case, the accounts receivable recording in the journal entry will be as follows:

| Date | ACCOUNT | DEBIT | CREDIT |

|---|---|---|---|

| 1/09/2020 | Account Receivables A/c | $30,000 | |

| To Sales A/c | $30,000 |

As shown, $30,000 will be debited from Account Receivables A/c as the amount has not yet been received by Company ABC. Alternatively, the same $30,000 will be credited to Sales A/c as sales of $30,000 has been made.

Journal entry for cash received in full for sales made on credit

Considering the preceding example, assume Mr. Peter made full payment of the $30,000 on 20th Sept 2020. In this case, a new entry for accounts receivable will be recorded as follows:

| Date | ACCOUNT | DEBIT | CREDIT |

|---|---|---|---|

| 20-09-2020 | Cash A/c | $30,000 | |

| To Account Receivables A/c | $30,000 |

Here, Company ABC has received full payment, so the $30,000 received will be credited in Account Receivable A/c. Hence, Account Receivables will now have a $0 balance as both credit and debit payments are $30,000. Whereas, $30,000 will be debited from Cash A/c.

Journal entry for part payment received for sales made on credit

Company ABC sold the pharmaceutical products on credit to Mr. Peter on the 1st of September, 2020 and the total amount on the invoice was $30,000 which he has to pay on or before 1st October 2020. Now, let’s assume Mr. Peter made a payment of $20,000 on the 20th, of September 2020. In this instance, a new entry will be recorded as follows:

| Date | ACCOUNT | DEBIT | CREDIT |

|---|---|---|---|

| 1/09/2020 | Account Receivables A/c | $30,000 | |

| To Sales A/c | $30,000 |

| Date | ACCOUNT | DEBIT | CREDIT |

|---|---|---|---|

| 20-09-2020 | Cash A/c | $20,000 | |

| To Account Receivables A/c | $20,000 |

Here, a payment of $20,000 has been received by Company ABC. The $20,000 received will be credited in Account Receivable A/c. Hence, Account Receivables will now have a $10,000 debit balance. Whereas, $20,000 will be debited from Cash A/c.

Journal entry for cash received for credit sales after discount

Company ABC sold the pharmaceutical products on credit to Mr. Peter on the 1st of September, 2020 and the total amount on the invoice was $30,000 which he has to pay on or before 1st October 2020. Now, if Mr. Peter makes full payment before 15th Sept 2020, a 5% discount will be given.

Say, Mr. Peter paid the full amount of $30,000 on 10th Sept 2020 and benefited from the discount. The journal entry will be as follows:

| Date | ACCOUNT | DEBIT | CREDIT |

|---|---|---|---|

| 1/09/2020 | Account Receivables A/c | $30,000 | |

| To Sales A/c | $30,000 |

| Date | ACCOUNT | DEBIT | CREDIT |

|---|---|---|---|

| 10/09/2020 | Cash/Bank A/c | $28,500 | |

| Sales Discount A/c | $1,500 | ||

| To Account Receivables A/c | $30,000 |

As shown, the discount of $1,500 will be debited from Sales discount A/c, and a debit entry will be made for the remaining $28,500 in Cash A/c. A credit entry will then be made for the full amount of $30,000 in Account Receivables A/c.

Journal entry recording sales on credit as a bad debt

When the customer doesn’t pay for what they owe, it is recorded as a bad debt (debt that cannot be recovered) in a direct write-off way. Alternatively, since there is a possibility that some receivables will never be collected, the account is offset (under the accrual basis of accounting) by an allowance for doubtful accounts.

Bad debts- Direct write-off way

Let’s assume due to family issues, Mr. Peter will not be able to make any payment for the $30,000 worth of pharmaceutical products bought on credit from Company ABC. The journal entry, in this case, will be as follows:

| ACCOUNT | DEBIT | CREDIT |

|---|---|---|

| Bad Debt A/c | $30,000 | |

| To Account Receivables A/c | $30,000 |

Here, because Mr. Peter is unable to pay the required amount, a journal entry will be made in Bad debts expenses and the Account receivables account will be credited with the write-off amount. This concludes that the total write-off amount will be transferred to the Profit and Loss Account and will reduce the net profit.

Bad Debts- Allowance method

Let’s assume due to losses in business, Mr. Peter will not be able to make any payment on or before 1st October 2020 for the $30,000 worth of pharmaceutical products. In this instance, a separate account of doubtful customers will be created to make an entry, which will not directly impact the Profit and Loss account. The journal entry, in this instance, will be as follows:

| ACCOUNT | DEBIT | CREDIT |

|---|---|---|

| Bad debts expense A/c | $30,000 | |

| To allowance for doubtful A/c | $30,000 |

Because there is a possibility that some receivables will never be collected, this allowance for doubtful accounts is used to offset the account. This allowance for doubtful accounts is an estimate of the total amount of bad debts that are related to the receivable amount. The total amount of money owed to the company minus bad debt or doubtful account gives the net receivable. Therefore, the net reported amount of the allowance and the gross receivable is the number of outstanding receivables that the company actually expects to collect.

Say, Mr. Peter later makes full payment on the 5th of November, the journal entry will be as follows:

| Date | ACCOUNT | DEBIT | CREDIT |

|---|---|---|---|

| 05/11/2020 | Allowance for doubtful A/c | $30,000 | |

| To Account Receivables A/c | $30,000 |

Related: Assets, Liabilities, Equity: Comparison

Why is accounts receivable a debit and not credit?

Increase in accounts receivable (debit or credit)

Assets have natural debit balances. Therefore, the positive values for assets are debited and the negative balances are credited. This means that a debit increases the balance of asset accounts whereas a credit decreases the balance.

Therefore, since accounts receivable are assets, their balance is increased on the debit side and decreased on the credit side. When the customer (the debtor) eventually pays, the cash account is increased and the accounts receivable account is decreased. Hence, the transaction is recorded as cash being debited and accounts receivable being credited.

See also: Is the common stock a current asset?