General Journal Examples – Entries and Calculations

After carrying out a business transaction, it is recorded in a book known as the general journal. The general journal is usually used in the first phase of accounting. It has all original transactions recorded in it, in chronological order. This is why it is also known as the book of original entry, chronological book, or daybook. In this article, we will discuss what a general journal is and show some general journal entries examples.

In the accounting cycle, the first step is transaction analysis which provides the information needed to journalize a transaction. Journalizing is the second step in the accounting cycle. This is the process of recording transactions in a journal. When a transaction is recorded in the books of accounts, it is referred to as making an entry. Therefore, recording a transaction in the journal is known as a journal entry. Let’s look at what a general journal entails.

Related: Sale of Assets journal entry examples

General journal Explained

The general journal is simply the book of original entries in which bookkeepers and accountants record raw business transactions in chronological order as they occur. It is the first place where transactions are recorded according to their dates. Therefore, the general journal is a diary of the business’s transactions.

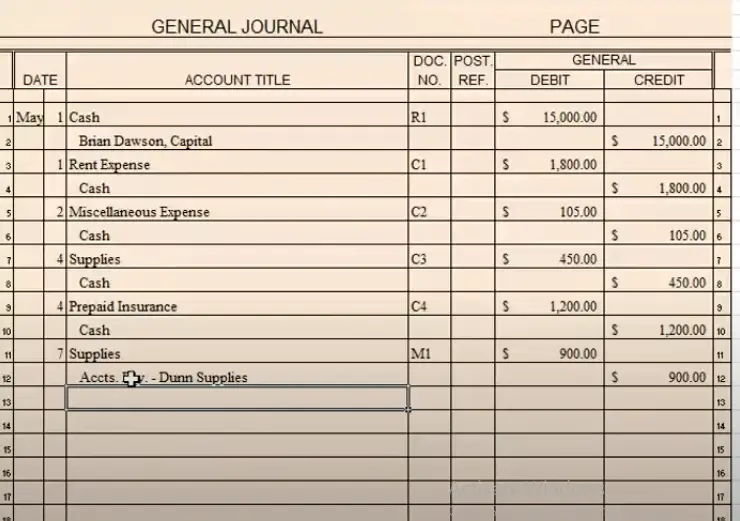

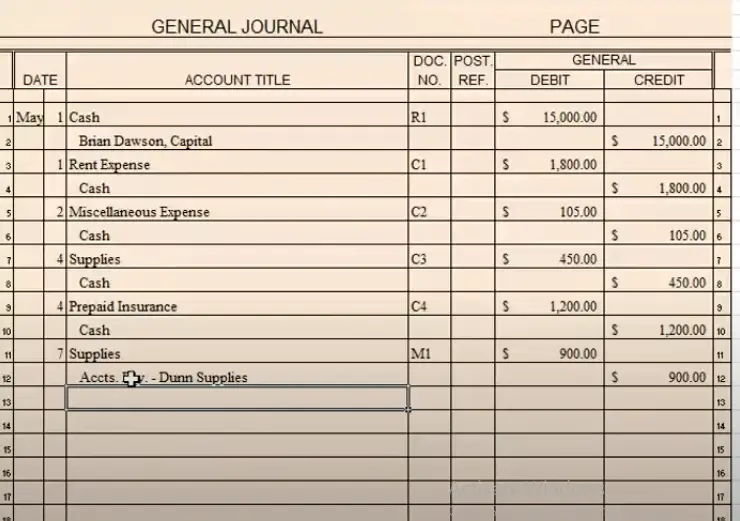

Source: Youtube

Usually, businesses record transactions in their general journal on a yearly basis and once a new fiscal year begins, they begin a new journal. Hence, every page in a general journal features dividing columns for dates, serial numbers, as well as debit and credit records. Therefore, each general journal description and entry normally contain at least five columns that specify the information, such as the date of a transaction, the associated serial numbers or accounts, and other elements such as the debit and credit records.

In a general journal, entries may appear alone or as a group of similar transactions. Once a business transaction is recorded in a general journal, the amount is then posted to the associated ledger accounts, such as the Equipment account, Accounts Payable, Accounts receivable, Cash account, etc. Some businesses may choose to only record specific types of transactions in a general journal. Some even keep specialized journals, such as sales journals or purchase journals, that only record specific types of transactions.

The purpose of a general journal

General journals are a chronological accounting record of a business’s financial transactions. The purpose of a general journal is to assist accountants and bookkeepers with the reconciliation of financial accounts and the creation of descriptive financial statements. Since the general journal contains a large amount of information related to cash receipts, purchases, payments, sales, and inventory balances, it may be used for the following purpose:

- Tracking the company assets and liabilities

- Recording transactions or actions of business events

- Reconciling accounts

- Tracking investing transactions for later taxation and audit processes

- Planning and allocating costs and expenses appropriately

- Tracking revenue, expenses, and other costs

- Releasing specific entries for the general ledger accounts

- Producing financial statements

It is necessary that a business continues to maintain its general journal and make accurate entries regularly so that all its costs may be realized and all funds may be allocated as needed. When a general journal is correctly formatted and successfully created, accountants can easily track spending and identify any miscalculations that may exist. The information contained in a general journal can be used to help compile financial statements like income statements, balance sheets, and cash flow statements.

See also: Gain on Sale journal entry examples

General Journal Examples – Entries format with Calculations

The bookkeepers or accountants of a business usually maintain the general journal. Even though some of the finer details and formatting of a general journal may be left to the discretion of the bookkeeper, the general format of journal entries in a general journal is fairly standard across all businesses. The general journal entry records the business’s financial transactions in order by date. Each journal entry must have two separate and distinct sides (debit and credit columns) so that the exact amounts on one side of the journal entry can be determined by subtracting the other side.

Hence, the format of a general journal entry would usually include the date of the transaction, the names of the accounts to be debited and credited (which should be the same as the name in the chart of accounts), the amount of each debit and credit, and a summary explanation of the transaction, usually known as a narration. Therefore, a standard general journal format would look like this:

| Date | Description | Posting Reference (PR) | Debit | Credit |

|---|---|---|---|---|

As seen in the table format above, a general journal typically has five columns. These are the function of the 5 columns:

Date

The general journal transaction entries always begin with a statement of the date that the transaction took place. The year, month, and date of a transaction are written in the date column. The year is entered immediately below the Date heading and is written once per page (that is, you don’t have to be repeating the year for every entry on the page).

The dates on the general journal are usually elaborated in a two-column format, with the first column containing the month and the second column containing the year. Several bookkeepers choose to enter the specific day with the description of each entry. That is, if the general journal only covers the transactions of one fiscal year, some bookkeepers may just provide a day and month rather than a month and year.

Every journal entry must have a date associated with it in order to ensure that a business’s financial statements are always produced in chronological order. The chronological order in the general journal is very important. If a company’s financial statements are not put together in the correct order, then the information that the statements contain would be incorrect. Hence, ensuring that you record dates properly will help keep your general journal accurate and organized.

Description

Continuing from left to right, the next column is the description column. This column details the account titles and an explanation of the transaction that has been made. The description column on the general journal is used to enter the names of the accounts involved in the transaction.

The debit part of the entry is first written and the credit part of the entry is written below the debit part. It is usually expected that you leave some space at the left-hand margin before writing the credit part of the journal entry. In this column, a brief description known as narration is written below the credit part of the entry.

The description of the transaction assists bookkeepers and accountants to recall what exactly happened on a certain date or why a transaction occurred. For instance, a description for a general journal may be written as ‘To record equipment purchase‘ or ‘To record inventory payment’.

Posting Reference (PR)

A column titled Post Ref comes after the description column. All journal entries are posted periodically to the ledger accounts. Hence, the PR column is used to state what page the information was copied to when the financial transaction was recorded on the journal ledger; which has information about separate accounts. That is, the page number of the ledger account to which the entry belongs is written in the posting reference column. For instance, if the cash account is on page number 99 in the ledger, the number 99 would be written in the posting reference column where the cash account appears in the general journal.

Debit and Credit columns

The next columns that come after the Post Ref column are the Debit and Credit columns, with the credited account being placed one row below the debited account. The debit column of the general journal is used to record the amounts of the accounts that are debited while the credit column is used to record the amounts of the accounts that are credited. The entry made in the debit and credit columns states the dollar amounts that have been spent or that need to be transferred between accounts.

The total amount of dollars in the Debit column must equal the total amount of dollars in the Credit column for an entry to be complete. This makes sure that all accounts are in balance and that multiple accounts (as many as needed) may be used on either side of the debit or credit column of the general journal to accurately track spending. Here is an example of how a general journal is usually formatted:

Format for general journal entries (examples)

| Date | Description | PR | Debit | Credit |

|---|---|---|---|---|

| 2022, Jan 1 | Inventory | 17 | $5,000 | |

| Cash | $5,000 | |||

| To record inventory payment | ||||

| Jan 3rd | Inventory | 19 | $3,000 | |

| Cash | $3,000 | |||

| To record inventory payment |

Rules for creating general journal entries

There are some accounting debit and credit rules to have in mind when using a general journal. In the general journal, there may be multiple debits or credit entries. However, the sum of the debits must always be equal to the sum of the credits. When making an entry you must always debit the receiver and credit the giver. Also, you have to debit all expenses and losses and credit all incomes and gains.

You are likely to make mistakes when using journals, thus, you can easily check for mistakes by adding both sides of your journal entry together. If they do not equal the same number, then there is an error nd you should know that something has gone wrong.

Each debit and credit account as well as the narration should be entered on consecutive lines. At least one line should be left blank before the next journal entry, and entries should not be split over more than one page. It has become a widespread practice to enter the debits first, followed by the credits and then the narration, though this is not a requirement. Nevertheless, whatever format you’ve adopted for your general ledger should be applied consistently.

Related: Credit Sales Journal Entry Examples

General journal entries examples

In many fields of business, general journals are used to logically track and identify important accounting information. Let’s look at the following general journal entries examples to show how the financial log can be used to record different numbers of transactions:

General journal entry: Example 1

Edward Retail Store entered the following three transactions into his accounting books:

- 5 June: Purchased $1000 worth of wine from the ABC Wine Company that arrived damaged. It was returned, and Edward’s account was reduced.

- 17 June: Anne Richard returned merchandise because it did not meet her needs. She received a $500 credit on her account.

- 30 June: Depreciation expense for the month is $1,500.

This is how these general journal entries examples would be shown in a general journal:

General journal entries examples to show Edward Retail Store’s transactions

| Date | Description | PR | Debit | Credit |

|---|---|---|---|---|

| 2022, June 5 | Accounts payable: ABC Wine | $1000 | ||

| Purchase return and allowance | $1000 | |||

| To record the return of damaged merchandise | ||||

| June 17 | Sales return and allowance | $500 | ||

| Accounts receivable: Anne Richard | $500 | |||

| To record returns to a customer for damaged goods | ||||

| June 30 | Depreciation expense | $1,500 | ||

| Accumulated depreciation | $1,500 | |||

| To record monthly depreciation expense |

General journal entries example 2

For our second example, the following transactions are related to Jotscroll company for January 2021:

| Date (Month) | Date (Day) | Transactions |

|---|---|---|

| January | 1 | Jotscroll company started a business with cash of $300,000 |

| 5 | The company purchased goods for $1,500 cash | |

| 7 | The company sold goods for $2,000 cash | |

| 9 | The company purchased goods from ABC Ltd for $3,000 | |

| 11 | The company received interest in cash of $2,500 | |

| 13 | The company sold goods to Anne for $5,000 | |

| 18 | The company returned goods to ABC Ltd worth $500 | |

| 20 | Returned goods from Anne worth $1,000 | |

| 25 | $2,200 was withdrawn from the company account by the owner for personal expenses | |

| 30 | The company paid rent of $3,500 |

Here is how the general journal entries examples to show Jotscroll transactions for the month of January would look like:

General journal entries examples to show Jotscroll company’s transactions

| Date | Description | PR | Debit | Credit |

|---|---|---|---|---|

| January 1 | Cash A/c | $300,000 | ||

| Capital A/c | $300,000 | |||

| To record the start of business with cash | ||||

| January 5 | Purchases A/c | $1,500 | ||

| Cash A/c | $1,500 | |||

| To record the purchase of goods with cash | ||||

| January 7 | Cash A/c | $2,000 | ||

| Sales A/c | $2,000 | |||

| To record goods sold for cash | ||||

| January 9 | Purchases A/c | $3,000 | ||

| ABC Ltd’s A/c | $3,000 | |||

| To record goods purchased on credit | ||||

| January 11 | Cash A/c | $2,500 | ||

| Interest A/c | $2,500 | |||

| To record interest received in cash | ||||

| January 13 | Anne’s A/c | $5,000 | ||

| Sales A/c | $5,000 | |||

| To record goods sold on credit | ||||

| January 18 | ABC Ltd’s A/c | $500 | ||

| Purchase return A/c | $500 | |||

| To record goods returned to the supplier | ||||

| January 20 | Sales return A/c | $1,000 | ||

| Anne’s A/c | $1,000 | |||

| To record goods returned from customer | ||||

| January 25 | Drawings A/c | $2,200 | ||

| Cash A/c | $2,200 | |||

| To record cash withdrawn for personal expenses | ||||

| January 30 | Rent A/c | $3,500 | ||

| Cash A/c | $3,500 | |||

| To record payment of rent |

General journal entries example 3

ABC International Ltd was incorporated in May 2021 with an initial capital of 10,000 common stocks of $10 each. During the first month of its operation the company had the following transactions:

| Date (Month) | Date (Day) | Transactions |

|---|---|---|

| May | 1 | $20,000 rent paid for the current month and $60,000 paid as an advance rent by the company for 5 months |

| 3 | Office supplies purchased on account having a cost of $22,500 | |

| 5 | Received $55,000 against the provision of services to the customers | |

| 7 | Furniture worth $20,000 purchased having trade discount of 10% | |

| 9 | Amount paid against the office supplies purchased on account on 3 May | |

| 11 | Equipment worth $60,000 was purchased by the company. $40,000 was paid in cash out of the total amount and for the balance amount, notes payable were issued with an 8.5% interest rate | |

| 13 | Provided services worth $60,000 to the customers | |

| 15 | Received $20,000 from customers against service provided on 13 May | |

| 17 | Stationery worth $1,500 purchased | |

| 23 | Received balance amount from customers against service provided on 13 May | |

| 27 | Electricity bill of $3,000 paid | |

| 30 | Telephone expenses of $2,500 paid | |

| 30 | Miscellaneous expenses during the month amounted to $6,300 | |

| 30 | Paid wages to the employees for the month of May amounting to $50,000 |

Here are the general journal entries examples to show all the transactions of ABC International Ltd for the month of May:

General journal entries examples to show ABC International Ltd’s transactions

| Date | Description | PR | Debit | Credit |

|---|---|---|---|---|

| May 1 | Cash A/c | $100,000 | ||

| Common stock A/c | $100,000 | |||

| To record common stock issued | ||||

| Rent A/c | $20,000 | |||

| Cash A/c | $20,000 | |||

| To record rent paid for the current month | ||||

| Prepaid rent A/c | $60,000 | |||

| Cash A/c | $60,000 | |||

| To record advance payment of rent for the next 5 months | ||||

| May 3 | Office supplies A/c | $22,500 | ||

| Accounts payable A/c | $22,500 | |||

| To record office supplies purchased on account | ||||

| May 5 | Cash A/c | $55,000 | ||

| Service Revenue A/c | $55,000 | |||

| To record cash received against the provision of service | ||||

| May 7 | Furniture A/c | $20,000 | ||

| Cash A/c | $18,000 | |||

| Trade Discount A/c | $2,000 | |||

| To record the purchase of furniture with a 10% trade discount | ||||

| May 9 | Accounts payable A/c | $22,500 | ||

| Cash A/c | $22,500 | |||

| To record payment of office supplies purchased on account on May 3 | ||||

| May 11 | Equipment A/c | $60,000 | ||

| Cash A/c | $40,000 | |||

| Notes payable A/c | $20,000 | |||

| To record the purchase of equipment with cash payment and notes payable | ||||

| May 13 | Accounts receivable A/c | $60,000 | ||

| Service revenue A/c | $60,000 | |||

| To record service rendered to customers on account | ||||

| May 15 | Cash A/c | $20,000 | ||

| Accounts receivable A/c | $20,000 | |||

| To record the amount received against the service provided to customers on account on May 13 | ||||

| May 17 | Stationery A/c | $1,500 | ||

| Cash A/c | $1,500 | |||

| To record the purchase of stationery | ||||

| May 23 | Cash A/c | $40,000 | ||

| Accounts receivable A/c | $40,000 | |||

| To record the amount received against the service provided to customers on account on May 13 | ||||

| May 27 | Electricity Expense A/c | $3,000 | ||

| Cash A/c | $3,000 | |||

| To record payment of electricity bill | ||||

| May 30 | Telephone Expense A/c | $2,500 | ||

| Cash A/c | $2,500 | |||

| To record payment of telephone expenses for the month | ||||

| May 30 | Miscellaneous Expense A/c | $6,300 | ||

| Cash A/c | $6,300 | |||

| To record payment of miscellaneous expenses for the month | ||||

| May 30 | Wages expense A/c | $50,000 | ||

| Cash A/c | $50,000 | |||

| To record payment of wages for the month |

General journal entries example 4

Let’s say Mr. Peter runs a footwear business and recorded the following transactions for the month of February 2022:

- On Feb 4, Mr. Peter purchased materials worth $50,000

- On Feb 8, he sold some footwear worth $80,000

- On Feb 15, he incurred expenses worth $5,000

- On Feb 17, he purchased a piece of furniture worth $7,000

- On Feb 20, Mr. Peter purchased some footwear accessories worth $5,000

- On Feb 23, some footwear accessories worth $500 were lost by fire

- On Feb 25, he lost some footwear accessories worth $900 as a result of theft

- On Feb 27, footwear accessories worth $700 were distributed as a charity

- On Feb 28, Mr. Peter withdrew some footwear worth $600

Here are general journal entries examples to show all the transactions that Mr. Peter will record for the month of February:

| Date | Description | PR | Debit | Credit |

|---|---|---|---|---|

| Feb 4 | Purchases A/c | $50,000 | ||

| Cash A/c | $50,000 | |||

| To record the purchase of materials with cash | ||||

| Feb 8 | Cash A/c | $80,000 | ||

| Sales A/c | $80,000 | |||

| To record the sale of footwear | ||||

| Feb 15 | Expenses A/c | $5,000 | ||

| Cash A/c | $5,000 | |||

| To record expenses incurred | ||||

| Feb 17 | Furniture A/c | $7,000 | ||

| Cash A/c | $7,000 | |||

| To record the purchase of furniture | ||||

| Feb 20 | Purchases A/c | $5,000 | ||

| Cash A/c | $2,500 | |||

| To record the purchase of footwear accessories | ||||

| Feb 23 | Loss by fire A/c | $500 | ||

| Purchases A/c | $500 | |||

| To record footwear accessories lost by fire | ||||

| Feb 25 | Loss by theft A/c | $900 | ||

| Purchases A/c | $900 | |||

| To record footwear accessories lost by theft | ||||

| Feb 27 | Charity A/c | $700 | ||

| Purchases A/c | $700 | |||

| To record footwear accessories distributed as charity | ||||

| Feb 28 | Drawings A/c | $600 | ||

| Purchase A/c | $600 | |||

| To record footwear taken by owner |

Read also: Cash sales journal entry examples