International Bill of Exchange (IBOE in Finance) | Bank Instrument

The international bill of exchange (IBOE in Finance) is a bank instrument used as a mode of business transaction that is intended to hold everyone accountable for making timely payments.

Individuals who operate a successful small business but do not want it to remain small may want to get their brand and products in front of new customers in new international markets. In order to do so, they have to navigate international trade processes, which entail a distinct set of risks and complexities, particularly in the post-Brexit environment.

Therefore, businesses and banks all over the world use bills of exchange to provide assurance and protection for such international trades. So, if you want to build strong relationships with clients from other countries, you’ll need to learn about bills of exchange. There are various types of bills of exchange but we will talk about the foreign bill that deals with international trades.

Before we proceed, let’s get to know what is a bill of exchange.

What is a bill of exchange?

It is essentially a formal, written IOU that specifies when a specific sum of money must be paid.

In other words, a bill of exchange is frequently used to secure a transaction. A bill of exchange is a legally binding agreement between buyer and seller in which the buyer agrees to pay a fixed sum of money at a predetermined date or upon demand from the seller, with banks typically acting as third parties in bills of exchange to ensure that funds are paid and received.

Related: Bill of exchange and promissory note

What are the key features of an international bill of exchange (IBOE in finance)?

The drawer (the person who writes the bill and orders that it be paid),

The drawee (the party who must pay), and

The payee (the party who is owed money).

- It must be written down in form of a document.

- It must include the names of all relevant parties.

- It must be addressed to one party only.

- It must bear the signature of the person presenting it.

- It must specify when the money is due.

- It must specify how much money must be paid.

- The bill must be paid in the country’s legal currency.

- It must be correctly stamped.

- It must be revenue stamped.

That means the drawer who demanded the money in the first place is not always the one who is owed money. Therefore, an international bill of exchange enables one party to demand payment from another.

Is an international bill of exchange a legal document?

While not exactly the same as a contract, they are similar types of documents, and a bill of exchange can also be used to ensure payment as part of a contract. Furthermore, the bill holder has the right to sue for any payments that are not made.

Information to be included in an international bill of exchange (IBOE)

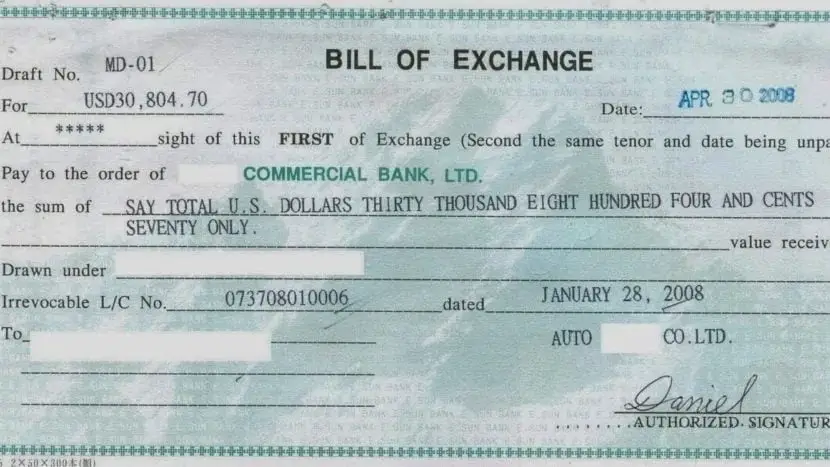

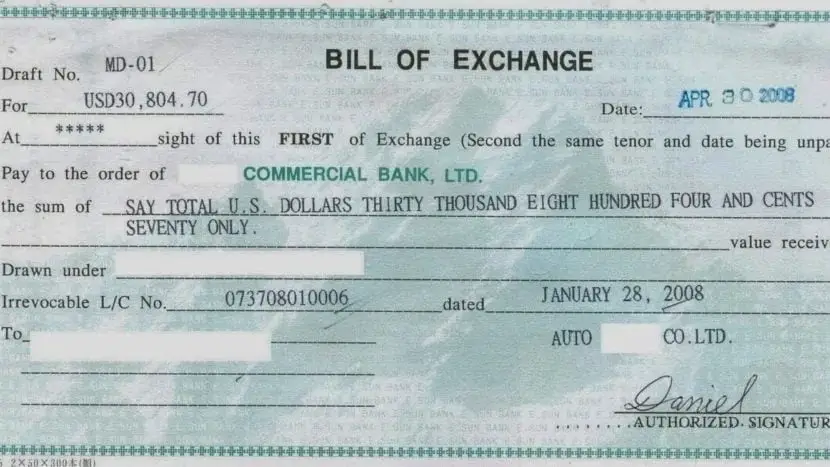

- Title -The term “bill of exchange” must be clearly stated on the face of the document.

- Amount – The amount to be paid must be stated clearly, both numerically and in text.

- As of – This refers to the time frame within which the amount must be paid. This could be upon delivery, shipment, or a predetermined date.

- Payee – The name (and possibly the address) of the person or entity to be compensated.

- Identification number – Each bill of exchange must be assigned a distinct identification number.

- Signature – The bill must be signed by someone who is authorized to bind the buyer/drawee to pay the specified amount.

A bill of exchange must include the above-stated information in order to be legally binding.

Related: Avalised Bill of Exchange

How to use an international bill of exchange

To streamline the process, a bill of exchange can be used when company A requests payment from company B and company B assigns the payment to company C. When it comes to international bills of exchange, the process is the same, but on a larger scale.

Consider the following scenario: Company A sells books purchased from company B, which then places orders with company C. Company B places an order with company C and then issues a bill of exchange requiring company A to pay company C upon receipt of the order.

Company B repays company C with money owed to company A. Although this may appear to be inconvenient, the main advantage of bills of exchange is that they do not have to be paid immediately. Bills of exchange have become less common in recent years, with other delayed payment methods, such as credit cards, becoming far more popular.

How to monetize an international bill of exchange (IBOE)

- The first step in monetizing an IBOE is to verify the bill of exchange. The owner of the bill will make sure that there is a serial or identification number on it. This will require the owner to use different platforms in verifying that the instruments in the IBOE are real.

- The next step after verification is to take the piece of IBEO to one of the top 20 banks in your location. When you get there, you ask the asset manager to give you a third-party appraiser on the value of your instrument in the IBOE.

- After valuation, the bank then issues a safe-keeping receipt (SKR) to you. The SKR will have the value of the instrument in your IBOE for what the bank agrees. In order to obtain the SKR, one must pay a fee for it. Because to make money, one has to spend some money.

- The last step is to take the safe-keeping receipt to a private equity firm and tender it in exchange for cash to finance the business transaction. We should also note that the firm responsible will charge some fees as well.

Bill of exchange example

Assume you own a vehicle repair shop that specializes in American car repairs and parts sales. This will inevitably necessitate ordering parts from abroad. Assume you buy £10,000 in parts from a vendor in the United States. They may then draft a bill of exchange requiring payment of £10,000 to be made within 30 days.

You will receive and accept the bill of exchange’s terms. The goods can now be safely dispatched because the agreement now binds both parties. The bill of exchange acknowledges the debt between the vendor and the creditor (you).

International bill of exchange sample

Mr. ABC drafts an international bill of exchange for Mr. DEF for $50,000 for three months, payable to Mr. GHI on April 15, 2018.

Mr. ABC has ordered Mr. DEF to pay Mr. GHI $50,000. If Mr. DEF agrees with the order, he will write across the bill as follows:

Accepted

Mr. DEF

Signature

Date

The bill becomes a bill of exchange when the drawee writes such an acceptance on it. In the preceding example, Mr. ABC is the bill drawer, Mr. DEF is the acceptor, and Mr. GHI is the payee. Mr. DEF will pay Mr. GHI the sum.