Types of Adjusting Entries with Examples

In accounting, there are different types of adjusting entries that reflect unrecorded business transactions that have taken place but have not yet been recorded; probably because it is either more convenient to wait until the end of the accounting period to record the transaction or because no source document concerning the transaction has yet come to the accountant’s attention.

These adjusting entries are used in the books to ensure the income statement reports the proper revenue or expense and to also ensure the balance sheet reports the proper asset or liability. This means that every adjusting journal entry affects at least one balance sheet account (asset or liability) and one income statement account (revenue or expense).

The use of various types of adjusting entries is necessitated by periodic reporting and the matching principle. The matching principle requires that an expense has to be reported at the same time as the revenue that it is related to. Therefore, following this matching principle, adjusting entries are the journal entries made at the end of an accounting period or at any time that financial statements are to be prepared in order to reconcile and bring about a proper matching of expenses and revenues.

During the accounting cycle, adjusting entries are made after the unadjusted trial balance and before the preparation of a company’s financial statements. Thus, bringing the amounts in the general ledger accounts to their proper balances. In this article, we will be discussing the different types of adjusting entries with examples but first, let’s have a better understanding of how adjusting entries work.

See also: Adjusting entry for supplies: examples and how to

What are adjusting entries?

Adjusting journal entries can also be referred to as financial reporting that corrects a mistake that has been made previously in the accounting period. In a financial journal, these adjusting entries ensure a business properly allocates its income and expenses. This is why an adjusting entry is entered at the end of a fiscal period to ensure that any income earned or expenses that have been incurred reflects the fiscal period in which they occurred.

Adjusting entries are entered using the accrual accounting method wherein transactions are recorded when a company performs services, rather than when it receives payment. The essence of the different types of adjusting entries is to convert cash transactions into the accrual accounting method which is based on the revenue recognition principle. This principle requires that revenue is recognized in the period in which it was earned, rather than the period in which cash is received.

For instance, assume ABC Company, a construction company begins construction in one accounting period but does not invoice the customer until the work is complete in six months. At the end of each of the months, ABC company will need to do an adjusting journal entry to recognize revenue for 1/6 of the amount that will be invoiced at the six-month point.

An adjusting journal entry relates to the balance sheet accounts for accrued expenses, accumulated depreciation, unearned revenue, allowance for doubtful accounts, accrued revenue, prepaid expenses, and deferred revenue. Also, the income statement accounts that may require an adjusting entry include depreciation expense, interest expense, insurance expense, and revenue. These entries are made in accordance with the matching principle in order to match expenses to the related revenue in the same accounting period and are carried over to the general ledger that flows through to the financial statements.

Read also: Credit Sales Journal Entry Examples

Types of adjusting entries with examples

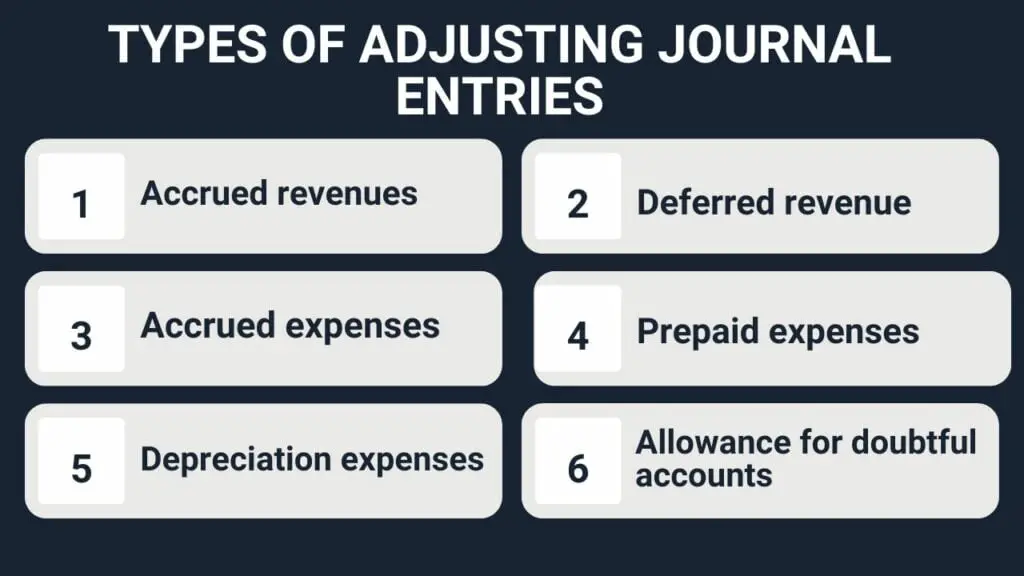

- Adjusting entry for Accrued revenues

- Adjusting entry for Deferred revenue

- Adjusting entry for Accrued expenses

- Adjusting entry for Prepaid expenses

- Adjusting entry for Depreciation expenses

- Adjusting entry for Provisions

The different types of adjusting entries fall into three broad classes- accruals, deferrals, and estimates. Accruals cover expenses and revenues that have not been paid or received, respectively, and have not yet been recorded through a standard accounting transaction such as accrued expenses and accrued revenues.

Deferrals, on the other hand, cover expenses and revenues that have been paid or received in advance, respectively, and have been recorded, but have not yet been used or earned such as deferred revenue or unearned revenue and prepaid expenses. While estimates cover adjusting entries that record non-cash items, such as allowance for doubtful accounts, depreciation expense, or the inventory obsolescence reserve.

Let’s further discuss these types of adjusting entries with examples:

Adjusting entry for Accrued revenues

The journal entry made for accrued revenue is one of the adjusting entry types in accounting. Revenue is accrued when you generate revenue in one accounting period, but don’t recognize it until a later period. That is, a business earns money for providing goods or services to customers but receives the payment for them at a later date.

In such a situation, you need to make an accrued revenue adjustment because it is very important that you accurately record revenue in the correct accounting period. Accrued revenues usually happen more with services and interest accrual. Here are journal entry examples of accrued revenue as one of the types of adjusting entries in accounting:

Accrued revenue as a type of adjusting entry: example 1

Take, for instance, Anne’s Apparel sells custom tote bags. In February, Anne makes $2,400 worth for you as her client and then invoices you. However, you pay the invoice on March 7. Anne’s Apparel definitely incurred expenses in February making the bags such as the cost of materials and labor, workshop rent, and utilities. Now, in order to accurately reflect her income for the month, she needs to show the revenue she generated in her books.

In February, when she produced the bags and invoiced you, she will record the anticipated income for the sake of balancing the books. That is, in her general ledger, the adjusting entries would look like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| Feb 25 | Accrued revenue | $2,400 | |

| Revenue | $2,400 |

Then, on March 7, when you pay for the bags and the money is deposited in the bank, she will move the money from the Accrued Revenue account to the Cash account.

| Date | Account | Debit | Credit |

|---|---|---|---|

| March 7 | Cash | $2,400 | |

| Accrued revenue | $2,400 |

Accrued revenue as a type of adjusting entry: example 2

Let’s assume a company hires painting services to repaint their office space in December. The whole service costs about $5,000, including labor and supplies. On December 30, the painter sends the invoice but receives payment on January 5. This transaction requires an adjusting entry. Therefore, this is how the painter will record this type of adjusting entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| December 30 | Accrued revenue | $5,000 | |

| Revenue | $5,000 |

| Date | Account | Debit | Credit |

|---|---|---|---|

| January 2 | Cash | $5,000 | |

| Accrued revenue | $5,000 |

Adjusting entry for Deferred revenue

One of the adjusting entries types is the journal entry made for deferred revenue (or unearned revenue). This is recorded when a customer or client pays for a product or service in advance. That is when you receive payment for goods or services that you are yet to deliver. Even though a business has been paid in advance for a service, it needs to make sure the revenue is recorded in the month that the service is delivered to the clients and actually incurs the prepaid expenses.

Deferred revenue is common in subscription models or when retail stores sell gift cards. For instance, you can receive payment as a gift card but will have to make the adjustment for the month when the customer redeems their card. Here are examples of deferred revenue as one of the types of accounting adjustments:

Deferred revenue as a type of adjusting entry example 1

Over the years, you’ve become well-respected in your business sector and let’s assume you’re invited to speak at the Annual Small Business Development Conference. Say, the conference showrunners will pay you $3,000 to deliver a talk on the changing face of your industry. After you confirm that you’ll be attending, they pay you in January and you’ll speak at the conference in March.

This transaction requires an adjusting entry for unearned revenue. Hence, you have to first record the income on the books for January as deferred revenue as a credit entry to your deferred revenue account for now. That is:

| Date | Account | Debit | Credit |

|---|---|---|---|

| January 6 | Cash | $3,000 | |

| Deferred Revenue | $3,000 |

Then when you deliver your talk in March and actually earn the fee, you will make an adjusting entry by moving the money from deferred revenue to service revenue. This is what it will look like:

| Date | Account | Debit | Credit |

|---|---|---|---|

| March 7 | Deferred Revenue | $3,000 | |

| Service Revenue | $3,000 |

Deferred revenue as a type of adjusting entry example 2

For our second example, let’s say a construction company signed an agreement to build a shed for a first-time homeowner. The company schedule the work to begin on May 10 but requires a down payment of $1,500 before the work begins. The homeowner pays this amount on April 30. This transaction requires an adjusting entry for unearned revenue. Here is an example of this type of adjusting entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| April 30 | Cash | $1,500 | |

| Deferred Revenue | $1,500 |

| Date | Account | Debit | Credit |

|---|---|---|---|

| May 30 | Deferred Revenue | $1,500 | |

| Earned revenue | $1,500 |

Adjusting entry for Accrued expenses

The journal entry done for accrued expenses (or accrued liability) is one of the main types of adjusting entries. This journal entry is made when you incur expenses in an accounting period but pay for them in the subsequent accounting period. That is accrued expenses account for expenses that are generated in one period, but paid for later. This is common with recurring bills, like payroll or utility expenses.

For instance, employees of a company may work throughout the month but receive a paycheck on the first of the following month. However, because the amount paid applies to the previous month, the company will have to make an accrued expense adjustment. Here are examples of accrued expense as one of the adjusting entries types in accounting:

Accrued expense as a type of adjusting entry example 1

In February, Anne’s Apparel hires a contract worker to help her out with her tote bags. She agrees in advance to pay them $500 for a weekend’s work. However, they don’t invoice her until early March. What she does is record the money in February as a credit to the accrued expense account and then debits the labor expense account. That is:

| Date | Account | Debit | Credit |

|---|---|---|---|

| February 21 | Labor expenses | $500 | |

| Accrued expenses | $500 |

When she pays the invoice in march, she moves the money from accrued expenses to the cash or bank account:

| Date | Account | Debit | Credit |

|---|---|---|---|

| March 1 | Accrued expenses | $500 | |

| Cash | $500 |

Accrued expense as a type of adjusting entry example 2

XYZ, Inc. worked in the office for the month of October. The amount of electricity the company used equaled $15,000 for the month. On November 1, the company received the bill and wrote a check to the electric company on November 2. They recorded this on an adjusted entry sheet for October:

| Date | Account | Debit | Credit |

|---|---|---|---|

| October 30 | Electricity bill | $15,000 | |

| Accrued expenses | $15,000 |

| Date | Account | Debit | Credit |

|---|---|---|---|

| November 2 | Accrued expenses | $15,000 | |

| Cash | $15,000 |

Adjusting entry for Prepaid expenses

Prepaid expenses are payments that a company makes in advance for goods or services. The journal entry for this sort of transaction is one of the types of adjusting entries. This is different from the case of accrued expenses as you make the adjustment to the month in the future when the service takes place. This type of accounting adjustment is common in advertising, advance rent payments, and prepaid insurance.

Here are examples of prepaid expense as one of the types of adjusting entries in accounting:

Prepaid expense as a type of adjusting entry example 1

Assume you rent a new space for your manufacturing business, and decide to make an advance payment of a year’s worth of rent in December. In December, you will have to record this transaction as a debit to a prepaid rent account and a credit to the cash account. That is:

| Date | Account | Debit | Credit |

|---|---|---|---|

| December 1 | Prepaid rent | $12,000 | |

| Cash | $12,000 |

Then, by the end of January, when you have used up 1/12 of the rent paid, you will have to record your rent expense for the month. So you will make an adjusting entry by moving January’s portion of the prepaid rent (an asset account) to an expense account.

| Date | Account | Debit | Credit |

|---|---|---|---|

| January 31 | Rent expense | $1,000 | |

| Prepaid rent | $1,000 |

Prepaid expense as a type of adjusting entry example 2

Mr. Peter started a new business in March and just paid for a new office space. In order to move in, he had to pay the first and last month’s rent. His lease officially starts on August 1, and he makes the payment of $1,800 on July 28 to ensure everything is ready. His recorded adjusting entry for this transaction would look like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| July 28 | Prepaid rent | $1,800 | |

| Cash | $1,800 |

| Date | Account | Debit | Credit |

|---|---|---|---|

| August 1 | Rent expense | $1,800 | |

| Prepaid rent | $1,800 |

Adjusting entry for Depreciation Expenses

Depreciation expenses are when you make a one-time payment to account for the loss in value of a fixed asset which is usually done with large purchases like vehicles, equipment, or buildings. You make a single payment when you depreciate an asset, but disperse the expense over multiple accounting periods. Each time you pay depreciation, it reflects as an expense on your income statement. Therefore, at the end of an accounting period wherein an asset is depreciated, the total amount of accumulated depreciation on your balance sheet changes.

The journal entry for depreciation expenses is definitely one of the common types of adjusting entries. The way depreciation is recorded on the books depends heavily on which depreciation method is used. You can calculate depreciation by subtracting the original value from the current value of the asset. Therefore, to record this as an adjusting entry, you have to divide this amount by the number of months that you’ve used the asset.

Nonetheless, you can calculate depreciation in other ways, and how you record it can vary based on your cash and tax liability. Here is an example of depreciation expenses as one of the adjusting entries types in accounting:

Journal entry of depreciation expense as a type of adjusting entry

A delivery company purchased a new car for $20,000. After a year of delivering and using the car, its value decreases by $3,000. When filing their taxes, the company pays a one-time $3,000 fee and submits adjusted entries of $250 for each month in the year. This is what the adjusting journal entry for this would look like:

| Date | Account | Debit | Credit |

|---|---|---|---|

| December 30 | Depreciation expenses | $250 | |

| Accumulated Depreciation | $250 |

| Date | Account | Debit | Credit |

|---|---|---|---|

| January 5 | Depreciation expense | $3,000 | |

| Accumulated depreciation | $3,000 |

Adjusting entry for Provisions

Provisions are the amounts of money provided to a business to anticipate costs. The allowance for doubtful accounts is the most common provision and the journal entry for this is one of the main types of adjusting entry. Allowance for doubtful accounts can be used if you offer credit to customers and anticipate they may miss payments.

In business, there is a possibility that some debts will never be collected, thus, this allowance for doubtful accounts is used to offset the account. The allowance for doubtful accounts is an estimate of the total amount of bad debts that are related to the receivable amount. Here is an example of allowance for doubtful accounts as one of the types of adjusting entries in accounting:

Journal entry of allowance for doubtful accounts as a type of adjusting entry

If for instance, a business delivers products to a customer for $4,000; the customer paid $1,000 at first and the business offered credit payments for the remaining $3,000. The business will record this adjusting entry, as they anticipate the customer may not pay:

| Date | Account | Debit | Credit |

|---|---|---|---|

| June 1 | Bad debts expenses | $3,000 | |

| Allowance for doubtful accounts | $3,000 |

However, if the customer later pays the debt, the journal entry will be as follows:

| Date | Account | Debit | Credit |

|---|---|---|---|

| December 31 | Allowance for doubtful accounts | $3,000 | |

| Accounts receivable | $3,000 |

Check out: Cash sales journal entry examples

Conclusion

In conclusion, all these types of adjusting entries are designed to make sure that the financial statements of a company accurately reflect its financial position. Going by all the types of adjusting entries with examples discussed, we can see that adjusting entries usually involve shifting or reclassifying amounts from one account to another which is very necessary for a variety of reasons. All the adjusting entries types are necessary in order to record revenues and expenses accurately.

Accruals, deferrals, and estimates all follow the matching principle that requires expenses to be recorded within the same period as the revenue that relates to the expenses. Hence, all types of accounting adjustments when applicable should be done to ensure accounting records reflect this matching principle at the end of each period. If these adjusting journal entries are not made when necessary, a company’s net income, assets, and owner’s equity will be overstated and its expenses will be understated.